In line with their aim to forge a more progressive future, Audi has unveiled a new partnership with The Curve — the revolutionary financial literacy platform created by Victoria Harris and Sophie Hallwright. A perfect pairing, the partnership was born from Sophie’s well-documented desire to own her ‘dream car’ (an Audi e-tron) and her savings journey to get there. The two entities have tapped into their shared values to create a helpful tool that will do just that — the Savings Calculator.

Simple and user-friendly, the Audi x The Curve online Savings Calculator not only makes savings goals feel achievable (no matter how audacious) but provides tailored, monthly payment suggestions that will actually get you there. It demonstrates how saving for big-ticket items — like a dream car — can be easy and shifts the narrative for women who have historically been left behind in the conversations around making big purchases themselves. The difference between the ways in which men are empowered to save and to spend on big-ticket items, versus the ways that women are more-or-less disregarded in that pursuit is something that both The Curve and Audi feel passionately about. “We are always looking for new ways to drive a more progressive future,” Audi’s Marketing Manager, Amy de Vries explains. “We want to give New Zealand women the confidence to set a significant savings goal this year, regardless of how much money they earn or what they are saving for.”

For Audi, this partnership comes off the back of campaigns like last year’s Scrap Girl Car initiative, in which they invited Kiwis to take part in scrapping outdated gender stereotypes by scrawling messages on an actual Audi RS e-tron GT, transforming it from stereotypical pink to black over a number of days.

Here, we sit down with Victoria and Sophie from The Curve to talk about their savings tips and tricks, their dream car, and how their partnership with Audi is helping women get ahead.

Tell me about The Curve’s new partnership with Audi. What brought you together?

Originally we saw their Scrap Girl Car campaign and were really impressed with the way a global brand like Audi was not afraid to start conversations about important topics like gender diversity. We thought it was really cool how an automotive brand was going out of its way to be inclusive, which is obviously something we are big on at The Curve, and not something we see in the motoring industry very often.

Before we spoke with Audi, I admitted on The Curve’s Instagram account that I’m ashamed of my car and that I’m also ashamed of admitting that I want to buy a new one. This turned out to be an extremely relatable topic for our community and it posed multiple questions — why do women feel guilty about buying expensive items? Why shouldn’t we be able to spend our hard-earned money on whatever we want?

Audi completely understood these issues and wanted to help us change this outdated mentality, empower women to set a significant savings goal this year, and help them to achieve it. This is where the savings calculator was born.

Why has the discussion around savings & money management historically left women behind?

For generations, women were less likely to be the ‘breadwinners’ of the household, or have any income of their own, and as a result, women were left out of all kinds of financial discussions which really shouldn’t be the case and isn’t the case in many instances now.

A mutual friend once said to us “my dad only discussed investing with my brothers, he thought I wasn’t interested”. This is a narrative we hear a lot, and this lack of financial literacy is self-perpetuated by not talking about money or savings. For so long we have been conditioned to think that conversations about money are rude but it’s so important to break that stigma. The more we talk the more we’re all going to learn.

Despite women now being much more equal participants in the workforce, and more equal contributors to household finances, the education and knowledge around investing and how to successfully grow our wealth is still lacking. The investing and saving knowledge gap continues to compound the wealth discrepancy (excuse the pun), so the first step is making women feel comfortable entering these conversations.

What needs to be done to help to empower women around their money and savings?

It sounds corny but with knowledge comes power. Understanding how to grow our money can be so empowering. Not only does it improve your confidence, but it also leads to financial independence, flexibility and choice. It gives women more control over their lives. It gives them freedom.

There is a level of self-responsibility too, we need to encourage each other to learn and step outside of gender and societal norms. We hope that by having these conversations we start to see generation shifts. We want to see women freely sharing knowledge, empowering each other to be financially independent and essentially reach equality.

Tell me about how The Curve has been working to do that.

Vic has been in the finance industry for over a decade and for the same amount of time, she has seen the women around her struggle with confidence when it comes to their finances. No one seemed to even know what a term deposit was, let alone inflation or interest rates.

It was a total blind spot for all of our friends and because the existing information was so masculine, boring and hard to understand, most of them remained uninterested or confused. We set up The Curve to change that. To make talking about money more interesting, more fun and hopefully even a little entertaining. We’re big advocates of having a laugh while simultaneously educating because, honestly if something is boring, not many people are going to pay attention.

The Curve represents modern women. The woman who works for her money, who wants to spend it in whatever way she sees fit and who doesn’t need to rely on a male counterpart to plan or live in line with her morals and desires.

We try to open up conversations whether that be on our podcast, or on our socials, in a way that is inclusive for ALL women. We wanted The Curve to feel like a safe space for women to get investment-savvy, without the noise and confusion.

Tell us about the Savings Calculator you created with Audi. How does it work?

It’s so cool we love it! Anyone can use it and it’s such a great start if you want to save for something but have no idea what that process looks like. Often big, audacious goals feel unachievable, but when broken down into monthly payments and you’re given a timeline as to how long it will take then all of a sudden it’s less overwhelming and is actually an achievable goal. We also wanted to show people that if they invest their savings they can reach their goals so much faster, so incorporating that element into the calculator was really important.

You literally type in what you’re saving for, whether that be a holiday, a car, a wedding (anything you want) when you want to buy it buy and whether or not you plan on investing those savings to grow them quicker, and then it spits out how long much you’ll need to contribute monthly to get there. VERY HELPFUL TOOL! We’ve also created a downloadable resource with a whole lot of tips and tricks to help you reach those savings goals faster which is super helpful if you see the monthly number and still don’t really know where to start.

Alongside the Savings Calculator, what are some easy-to-implement tips and tricks for saving that people can use once they’ve set their goal?

Visualising your goal can help in a massive way. It creates motivation and means you are less likely to stray off course. And be specific. Changing the narrative from “I want to save some money” to “I want to save $50,000 in 5 years to buy an Audi” has a profound effect on our ambition and drive (really on fire with the puns).

What would you say to someone who has always felt like those more expensive items (like a new car) are out of reach?

This Savings Calculator is a great place to start. You can see how much you have to save each month to achieve your goal – however aspirational it might be! Then you can work from there to see if it’s achievable with your current situation and how much you’re keen to invest to help you achieve that goal. The bigger the savings goal (or the more expensive the car), the longer it might take you to achieve – but it is never completely out of reach!

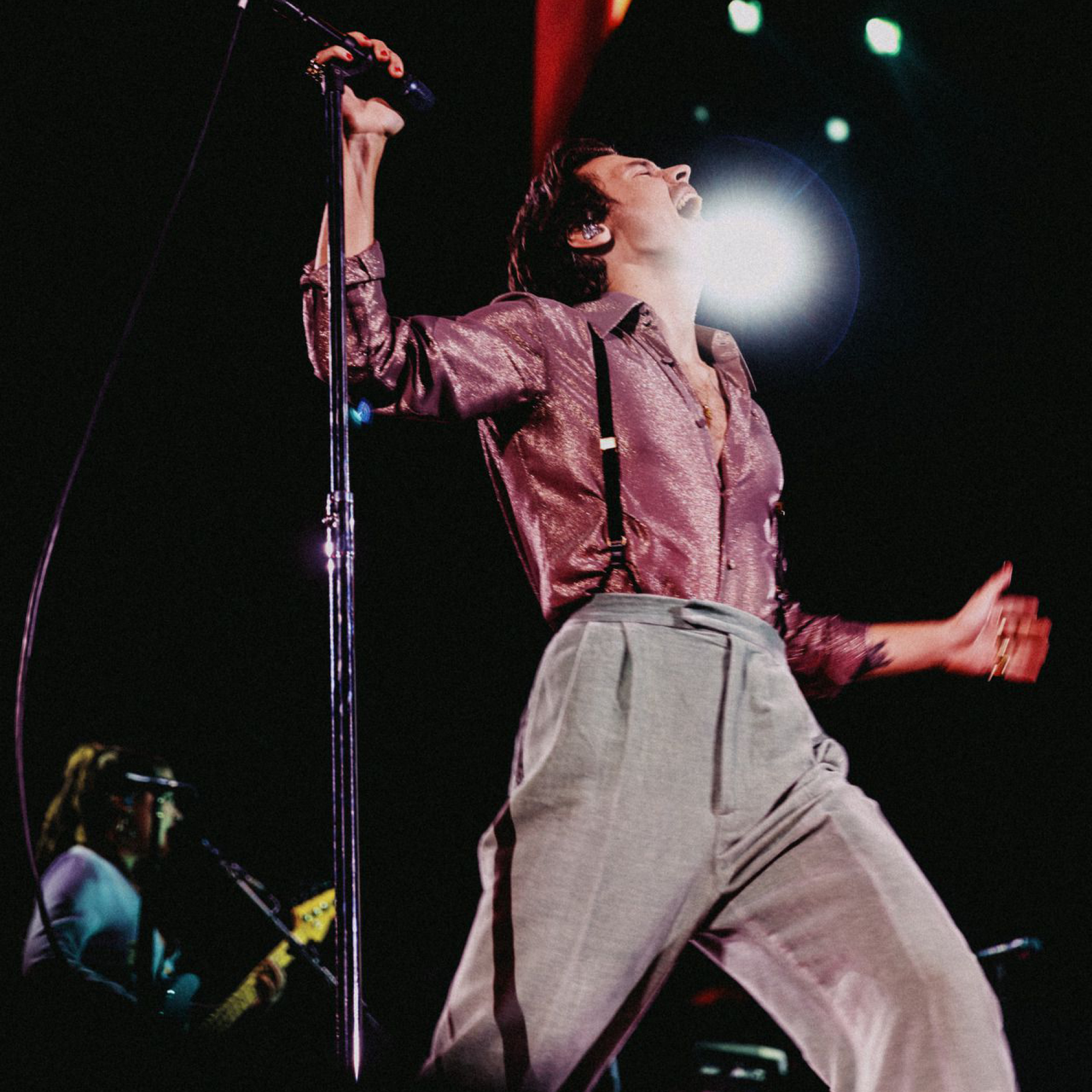

Why is the fully electric Audi e-tron your dream car? Have you loved driving it over the summer?

I have LOVED it. We have always been huge fans of the Audi brand. It’s beautiful, and aspirational, just like our community of women! The e-tron is spacious, luxurious and so powerful with its fully-electric motor. Vic’s favourite unique feature is definitely the tightening of the seatbelts ever so slightly as you drive away, it feels like a friendly little hug. Soph has so many favourite features, she’s used to driving with headphones to listen to music (not that cute). The sound system in the Audi e-tron is insane, being able to talk on the phone while driving and not having to put the keys in the ignition! It’s amazing.

More importantly, it has saved us amazing amounts of money on petrol (and we are all about saving $$). When you combine that with the positive environmental effects which couldn’t be more important, considering the current state of the world right now, it’s an absolute dream to drive.

This competition is now closed.